When you’re about to make a big purchase, you may have received an offer at checkout to pay in installments and with no interest. This is what’s known as a “Buy Now, Pay Later” offer (BNPL). As online shopping continues to grow post-pandemic effect, BNPL is becoming the most popular trend for conducting business. As matter of fact, the growing BNPL trend has benefits to both businesses and consumers.

What is BNPL and how it works?

Buy Now Pay Later (BNPL) is a payment option that allows customers to make purchases online, or at stores, without having to pay the complete amount upfront. This payment option allows customers to pay their purchases in installments, with an agreed specified payment term, with 0% interest, rather than paying the full amount ahead. This trend offers customers flexible payments options, interest-free installments. How can this be not appealing?

It is not surprising to note that the BNPL payment option is most popular among Millennials and Gen Z customers. Young customers, with tight finances and less available credit, are always looking for convenient, flexible budgeting solutions that meet their limited budget. Especially without having to pay interest. Statistics show that BNPL is highly desired as a type of payment among younger demographics. This is due to their use of mobiles apps that facilitate easy, smooth shopping experiences. On the other hand, retailers are leveraging social media platforms for targeting this age group to generate sales.

BNPL what you should know:

Over half of U.S. adults (aged 35 and over) stated that, they had not and that they were not, interested in this method of payment, according to Statista. However, younger consumers had a more welcoming approach towards such services, as about 16 percent of consumers (aged 18 to 34) used this method on a regular basis.

BNPL payment plans, also known as “point-of-sale loan,” is becoming widely used by many companies today. Thanks to BNPL service providers such as Klarna, Affirm, and Afterpay have made it available for all sizes of businesses.

In 2020, BNPL accounted for 2.1% (about $97 billion) of that sum of all global eCommerce transactions. This figure is expected to double to 4.2% by 2024, according to Worldpay.

Kaleido Intelligence research states that according to Businesswire “Buy Now Pay Later” led by Klarna, PayPal & Afterpay, is expected to double by 2025, reaching $680 Billion.

According to Statista, BNPL Global market share is 2,1%. This growth can be seen in the monthly app installs of certain BNPL providers in the US. A figure that is doubled between April and September 2020.

Benefits of “Buy Now, Pay Later” for businesses and consumers

BNPL benefits for consumers:

- It does not require intensive credit checks in comparison to other financing methods. Unlike applying for a new credit card, it is easier to qualify for BNPL. It is a better alternative to traditional banking and credit cards. For young consumers, it is easier to get approved for this type of loan, especially ones with a low credit score. Thus, this payment option is appealing to other traditional financing methods.

- It is easier to purchase expensive products without being hard on their pockets. Many products like electronics, computers, TV, or household appliances are usually hard to pay in full all upfront. We see consumers are more likely to buy these expensive products if they can do monthly installments, free of interest. This option helps consumers to better manage their cash flow.

- It is simple, fast, and easy to do. In particular for online shoppers, millennials and Gen Z. buyers can choose the BNPL option while buying online with just a few clicks. Typically, buyers pay their first installment, get invoiced. Then their remaining balance is to be paid over monthly installments.

BNPL benefits for businesses:

- Attracts new customers and retains loyal ones. Likely, consumers will return to buy from a store that offers BNPL. Since not many businesses offer this service at the moment.

- BNPL offers a greater potential market share. Due to the effect of the pandemic, many consumers are out of work. Consumers are consistently looking for greater flexibility purchasing options, with the least financial commitments. Thus, businesses have a great opportunity to capitalize on this service and increase their market share.

- Better cash flow for businesses. BNPL is a fast and straightforward method, in comparison to other traditional payment methods. BNPL providers pay retailers in full immediately. This in turn allows retailers to have a better cash flow to stock up their inventory. If the consumer fails to pay on time, retailers do not have to worry about lost revenue. Or even when someone returns merchandise after purchase. According to Payments Journal, a BNPL provider charges buyers a fixed transaction fee and a percentage of the sale. Thus it is a win-win situation.

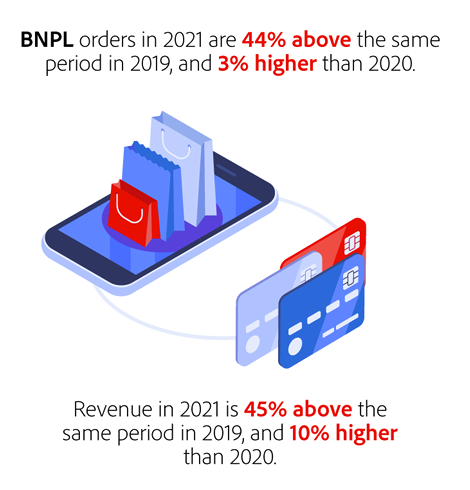

- Increase in order numbers and higher conversion rates. Retailers who offer BNPL payment options for their customers, generate more orders. BNPL providers often take a cut from the buyer on each transaction made. According to Payments Journal, Klarna states that integrating BNPL as a payment option, lead to a 44% increase in orders and a 68% increase in order volume.

How do eCommerce solutions make it easy for businesses to integrate BNPL?

Ecommerce solutions provide easy seamless payment options for retailers on their online store to offer to their customers. DigiCommerce helps with setting up automated payment installments. DigiCommerce Headless Enterprise Solution is an eCommerce solution that allows businesses to integrate seamlessly with their external 3rd party platform. These 3rd party platforms could be Worldpay, Stripe, Payway, PayPal, Chase, Moneris, Klarna, and CyberSource.

According to the adobe holiday shopping report, “consumers are using BNPL for increasingly less expensive orders with the minimum order value of $225, reflecting a 12% drop from 2020 to 2021.”

In summary, there are many benefits for BNPL to both businesses and consumers. Needless to say, to remain competitive, businesses and retailers must provide a seamless shopping experience to their customers. It is also essential to offer as many payment options as possible to meet their consumers’ needs. Whether in-person shopping or online stores, the BNPL option seems to attract more customers every day. Given that the pandemic’s influence is likely to extend into 2022. Consumer shopping behavior will continue changing, the same as the BNPL expected to be their favorite payment option. Simply BNPL probably won’t go away anytime soon. It is likely here to stay!