One of the cornerstones of success in B2B commerce is streamlined payment solutions. As businesses continue to transition and grow online, the demand for easy and secure transaction methods has never been higher. In this blog, we’ll explore how integrating payments within eCommerce platforms, offering personalized payment experiences and enhancing security are changing the way businesses conduct transactions.

Streamline Transactions with Integrated Platforms

One of the most significant advancements in B2B payment solutions is the integration of payment functionalities within eCommerce platforms. Instead of relying on separate systems for order processing and payment processing, businesses can now leverage integrated platforms that offer a seamless end-to-end experience.

According to a survey conducted by Aberdeen Group, businesses that integrate their eCommerce and payment systems experience a 23% increase in customer satisfaction and a 30% reduction in operational costs. This integration not only simplifies the transaction process but also enhances visibility, control, and efficiency:

- Seamless User Experience: When customers can complete their entire purchasing journey, from browsing products to making payments, within a single platform, it creates a seamless and convenient experience.

- Reduced Friction Points: Integrating payment functionality eliminates the need for customers to navigate to external websites or systems to complete transactions. This reduces friction points in the buying process, leading to higher conversion rates and improved customer satisfaction. Research by Baymard Institute suggests that simplifying the checkout process can decrease cart abandonment rates by up to 35%.

- Enhanced Security: Integrated payment systems often come with robust security features, such as encryption and fraud detection, which help protect customer data and mitigate the risk of fraud.

- Real-Time Transaction Updates: Integration allows for real-time communication between the eCommerce platform and the payment system, enabling instant updates on transaction status, order confirmation, and shipping details. This transparency enhances the overall customer experience and fosters trust and satisfaction. A report by McKinsey & Company highlights the importance of real-time updates in building customer loyalty and engagement.

- Streamlined Operations: For businesses, integrating eCommerce and payment systems streamlines operations by centralizing data, automating processes, and reducing manual intervention. This leads to greater efficiency, lower overhead costs, and faster order fulfillment.

Personalized Payment Experiences

Delivering personalized experiences is key to building customer loyalty and driving repeat business. B2B payment solutions now offer customization options that enable businesses to tailor the payment experience to meet the unique preferences of their customers. From flexible payment terms and pricing models to branded payment portals and self-service options, businesses can create a seamless and personalized payment journey that enhances customer satisfaction and loyalty.

Statistics show offering a variety of payment options to accommodate diverse customer preferences, reduce cart abandonment rates and ultimately enhance the overall shopping experience. For example, the lack of desired third-party payment methods continues to be an abandonment point for some users. Research by Worldpay found that 59% of consumers globally have abandoned an online purchase because their preferred payment method wasn’t available.

Digital Wallets and Mobile Payments Continue to Rise

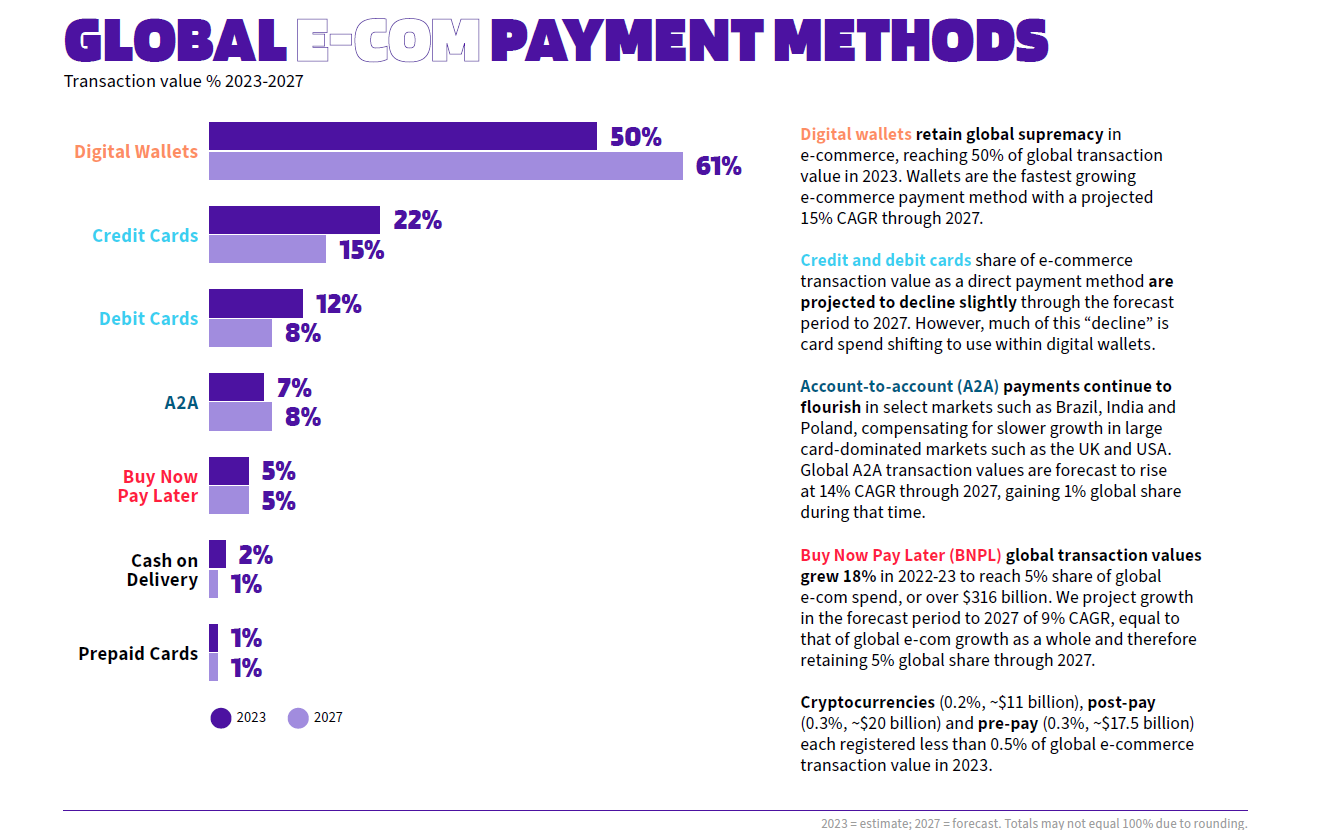

Digital wallets and mobile payment technologies have transformed the way B2B transactions are conducted, offering convenience, speed, and security. With digital wallets, businesses can store payment information securely and initiate transactions with a few clicks or taps, eliminating the need for manual data entry and reducing the risk of errors. Moreover, mobile payment solutions enable businesses to accept payments on the go, empowering sales representatives and field agents to close deals efficiently.

According to Worldpay, digital wallets remained the people’s payment choice for payments in 2023, accounting across channels for a combined $14 trillion in consumer spending.

Source: Worldpay Payment Report 2024

Enhanced Security and Fraud Prevention

Several studies have shown trust and security play significant roles in consumer purchasing decisions. A report by Baymard Institute found that 17% of online shoppers abandon their carts due to concerns about payment security. Similarly, a survey by GlobalSign revealed that 77% of consumers are concerned about the security of their personal information when making online purchases.

Security concerns have always been a top priority for B2B businesses, especially when it comes to financial transactions involving sensitive information. The new age of B2B payment solutions addresses these concerns by implementing security features such as tokenization, and strong customer authentication. These technologies not only protect sensitive data from unauthorized access but also mitigate the risk of fraud and chargebacks, providing peace of mind for both buyers and sellers.

Tokenization

Tokenization replaces sensitive payment card data, such as credit card numbers, with unique, randomly generated tokens. These tokens are meaningless to hackers if intercepted, significantly reducing the risk of data breaches and fraud. Even if a token is compromised, it cannot be used to make unauthorized transactions. According to a report by Juniper Research, tokenization is expected to prevent over $25 billion in fraudulent transactions annually by 2025, highlighting the effectiveness of this technology in mitigating fraud risk.

Tokenization streamlines payment processes by allowing merchants to store and transmit tokens instead of sensitive payment card details. This simplifies recurring payments, subscription billing, and other transactions where storing payment information securely is necessary but poses risks.

The impact of enabling customers to perform multiple, repeated, or recurring transactions without needing to enter their payment information for each purchase can be substantial, leading to increased convenience, improved customer satisfaction, and potentially higher conversion rates. While specific statistics on this topic may vary depending on the industry and individual business practices, there are several general trends and insights that highlight the benefits of frictionless payment experiences:

1. Increased Conversion Rates: Streamlining the checkout process by allowing customers to store payment information for future use can reduce friction and barriers to purchase. According to a report by Baymard Institute, 28% of online shoppers abandon their carts due to a long or complicated checkout process. Enabling one-click or saved payment options can help reduce cart abandonment rates and increase conversion rates.

2. Enhanced Customer Experience: Simplifying the payment process by eliminating the need to re-enter payment information for repeat purchases improves the overall customer experience. A study by Forrester Consulting found that 77% of consumers agree that valuing their time is the most important thing a company can do to provide good online customer service. Offering seamless, frictionless payment options aligns with this expectation and can lead to greater customer satisfaction and loyalty.

3. Encourages Repeat Business: By making it easier for customers to make repeat purchases, businesses can foster loyalty and encourage repeat business. A report by Adobe found that returning customers generate three times more revenue per visit compared to one-time shoppers. Seamless, one-click purchasing experiences contribute to building long-term relationships with customers and increasing their lifetime value to the business.

4. Reduction in Cart Abandonment: Simplifying the checkout process and reducing the number of steps required to complete a purchase can help reduce cart abandonment rates. According to the Baymard Institute, the average documented online shopping cart abandonment rate is around 69%. By offering saved payment options, businesses can mitigate this issue and recover potentially lost revenue.

Strong Customer Authentication

The intention of the Strong Customer Authentication requirement is to reduce fraud, provide added security to online payments, and act as a frictionless authentication – improving the payment experience and providing security against the emergence of new online payment threats. These are all great practices. To mimic the SCA, consider its three main criteria for authentication – something the customer knows, something the customer has, the customer themselves.

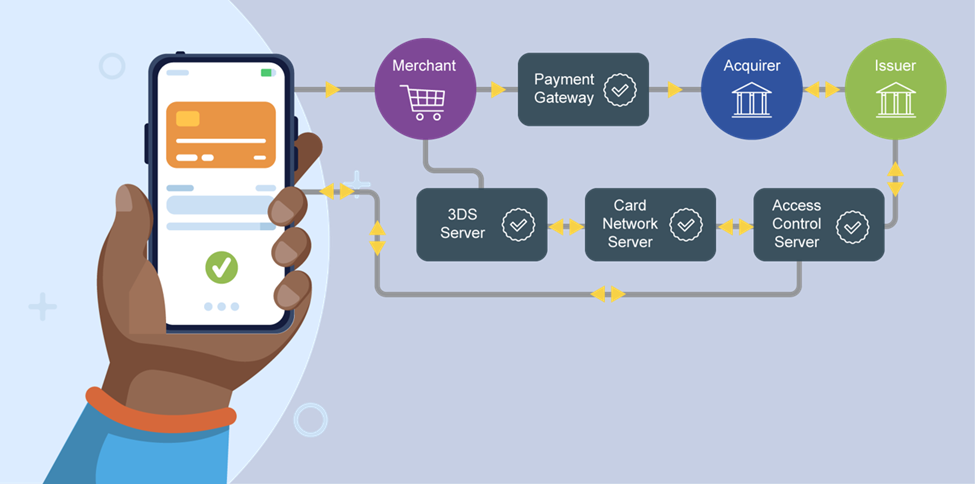

One of the stronger methods of customer authentication is 3D Secure. 3D Secure takes transaction-specific information (like shipping address) and contextual information (such as order history) to verify the identity of the shopper. Adding 3D Secure to your checkout process doesn’t create friction – in fact, it can result in higher authorizations and reduced chargebacks. It also shifts the liability off you and on to the cardholder’s bank.

Security vs. Usability

Implementing payment security measures is a fundamental aspect of safeguarding sensitive customer information. Utilizing encryption technologies, secure payment gateways, and multi-factor authentication are all ways that can reduce the risk of unauthorized access and fraudulent activities.

However, its equally important to maintain a user-friendly payment experience that doesn’t compromise efficiency or frustrate customers. Lengthy and complex security processes can deter potential buyers and lead to abandoned transactions. Whenever implementing payment security, see if it impacts customer purchasing behavior. Assess whether that payment security is resulting in more false declines. Measure business outcomes until they are optimal with the payment security in place.

The new age of B2B payment solutions represents more than just a technological advancement; it symbolizes a fundamental shift in the way businesses perceive and execute transactions. By integrating payment functionalities within eCommerce platforms, delivering personalized payment experiences that leverage digital wallets and mobile payments, and enhancing security, B2B eCommerce owners can unlock new opportunities for growth and success. These innovative payment solutions make it possible for businesses to go beyond traditional boundaries and embrace a future where transactions are not merely transactions – but experiences that resonate with customers.

Kimberly Miller is a technology industry veteran with a not-quite mundane past and a storied future. As Executive Vice President of Strategy and Business Operations, Kim brings decades of experience in business development and digital transformation in the technology, software, and self-service solutions industries to Payway, a cloud-based software company.